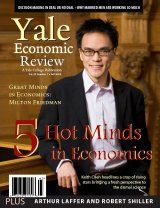

Young Guns: Five Hot Minds in Economics

by the YER Staff...

Markus Brunnermeier

Markus Brunnermeier could have been a carpenter, a politician, or a neuropsychologist. For a little while, he was a tax official in Munich. But now, as a professor at Princeton University and an academic consultant to the Federal Reserve Bank of New York, Brunnermeier has ended up as one of the most distinct voices in the debate over financial markets in America.

As a sixteen-year-old in Landshut, Germany, Brunnermeier was convinced that he was going to take over his father's carpentry business. "There is probably no economist who has hammered more nails than I have," he jokes, 21 years later.

How, then, did building houses in Bavaria lead to building economic models in New Jersey? "Growing up in Germany, I always wanted to have a better understanding of why the eastern part of the country - in which Communists had imposed a centralized economic system - was doing much worse, economically, than the western part with a free market system," he said. "Then I read that market prices convey a lot of information, and this informational role is suppressed in a centralized economy." Intrigued, he began to study the informational role of prices, which ultimately led to his current work in financial economics.

Brunnermeier studies significant mispricings due to institutional frictions, strategic considerations, and behavioral trading. Financial markets in particular assume rational expectations, in which agents base today's decisions on their predictions for the future. Under this framework, agents are aware of uncertainty's true objective probability distribution and make optimal decisions accordingly. Brunnermeier questions this assumption, arguing instead for a framework of optimal expectations. In the paper "Optimal Expectations," co-authored with Jonathan Parker, Brunnermeier posits that agents' optimism about risky events may lead them to prefer an uncertain probability distribution to the objective distribution. Pleasant surprises - anything from a birthday gift to an unexpected stock buyback - make an agent better off by introducing the uncertainty of more such surprises in the future. But by impairing predictions, the preference for such uncertainty explains observed departures from a rational expectations distribution. Brunnermeier's theory applies to phenomenon ranging from procrastination to preference for stocks that do extremely well with small probabilities.

Brunnermeier also investigates the situations in which these departures from the true value of assets grow into significant mispricings - a phenomenon known as a bubble. His approach departs from conventional wisdom, particularly the Efficient Market Hypothesis that rational speculators should immediately stabilize prices by shorting overpriced assets. Brunnermeier's paradigmatic shift holds that that rational traders prefer to ride a bubble rather than attack it. He asserts that rational traders know that they alone cannot burst the bubble; if they attack too early, they will forgo profits, and if they attack too late, they will suffer the crash. Facing this timing problem, all traders will ride the bubble even when they know the price exceeds its actual value. Hedge funds, for example, invested heavily in the overpriced technology stocks during the Internet bubble, often to great gain.

Most recently, Brunnermeier has applied his study of money illusions to house prices. He notes that people tend to base purchasing decisions on the nominal interest rate rather than the real, so that when inflation drives up the nominal interst rate, house prices go down. But because the decreased value of money offsets the increased nominal payment, the real present value of the mortgage has not changed - only the consumers' perceptions. To further understand such behavioral phenomenon in the macroeconomy, Brunnermeier hopes to pioneer a form of neurofinancial research, which will use MRIs to study the effects of stress on economic timing decisions.

As Brunnermeier's work continues to reflect the importance of a practical approach, it seems his carpentry training has stayed with him through all these years. Even as he chips at the foundations of economic thought and builds his own framework, he remembers never to dismiss the conventional wisdom of a laymen. His theories are always supported by empirical evidence and strongly reflect observable realities. "I try to go through the world with open eyes," he said. "There is always some practical knowledge which can help improve the academic approach."

...