Princeton University's financial aid policy is recognized as among the most generous in the country. The University's robust financial aid packages are built on grants rather than loans, which allow students to graduate debt free. This makes a Princeton education affordable for any student who is admitted to the University. In fact, Princeton is likely to be more affordable than a state university for lower- and middle-income students.

Princeton also is one of a handful of schools in the United States whose financial aid policy is the same for domestic and international students. In the 2014-15 academic year, about 60 percent of Princeton undergraduates received financial aid.

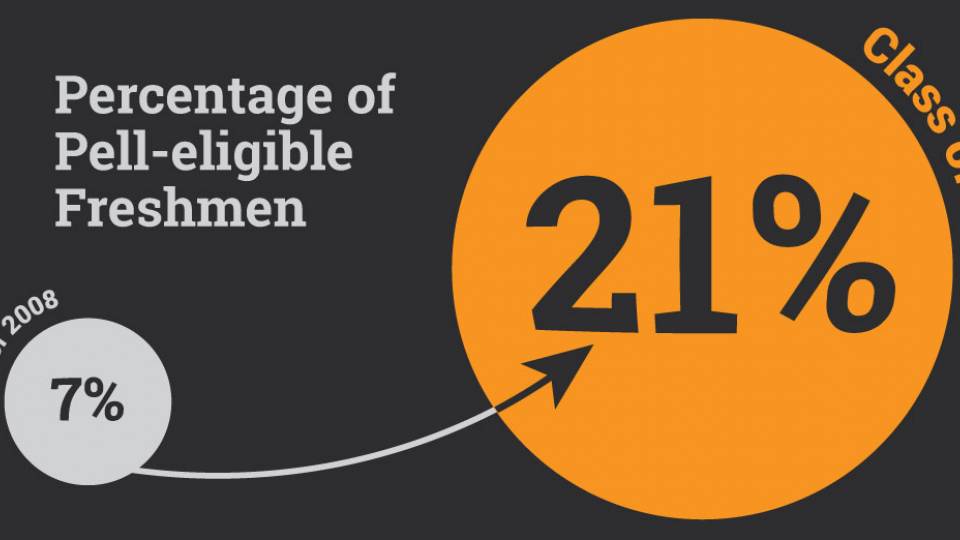

As a result of the University's efforts to increase the economic diversity of the student body, 18 percent of the freshman Class of 2018 received Pell grants, up from 7.2 percent for the freshman Class of 2008. Federal Pell Grants provide need-based grants to low-income undergraduates.

The images below provide details about Princeton's financial aid policies and how students from a broad range of socioeconomic backgrounds — from low-income to applicants with family incomes of $250,000 — can receive aid that meets their demonstrated need. For more information, visit the Office of Admission website, read the financial aid brochure "Making It Possible," and follow #AffordablePrinceton on Twitter, Facebook and Instagram.

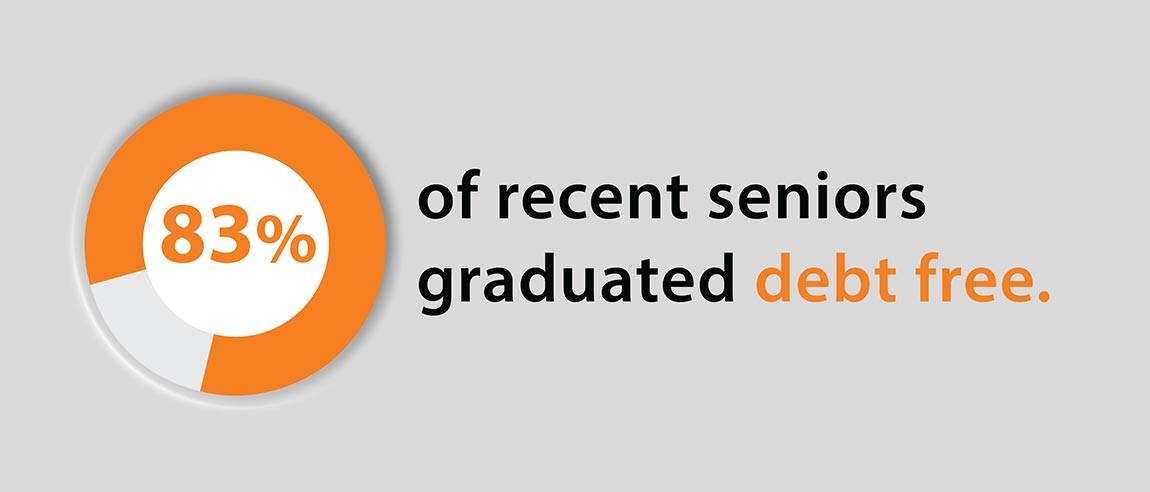

Princeton was the first university in the country to eliminate the need to take out loans. Every financial aid package relies on grants, not loans that have to be repaid. This makes it possible to graduate from Princeton debt free. About 83 percent of recent Princeton seniors graduated debt free.

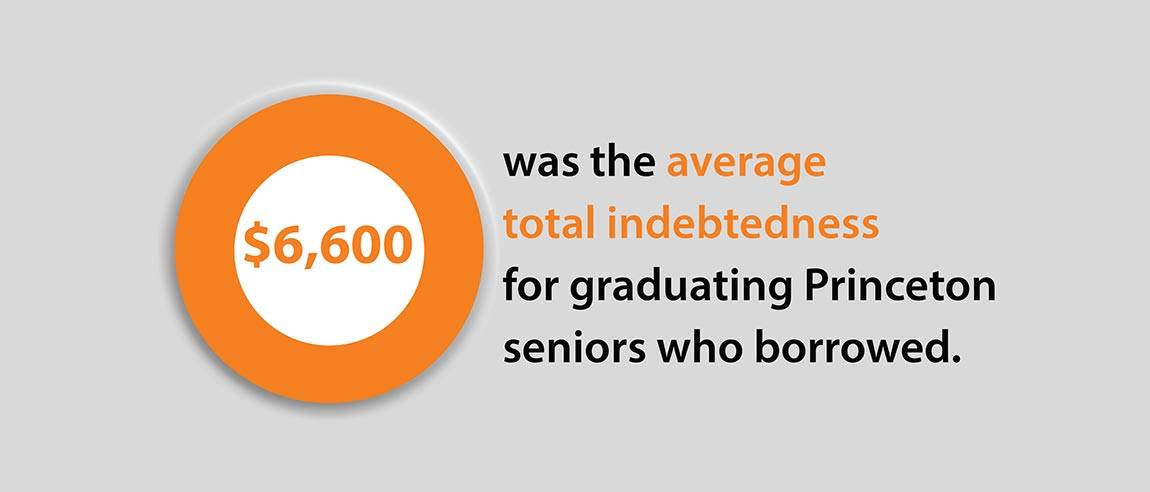

While a majority of recent Princeton seniors graduated debt free, about 17 percent chose to borrow, usually for additional expenses such as an unpaid internship or a laptop computer. For those Princeton seniors who chose to borrow, their average total indebtedness over four years was $6,600. This is much lower than the approximately 70 percent of college seniors in the United States who graduated with loans in 2013 and carried an average debt of $28,400. (Source: The Project on Student Debt)

U.S. News & World Report recently ranked Princeton University first on its lists of schools for best value and lowest student debt at graduation. The average graduating debt for those who borrowed is lower at Princeton than any other national university on the U.S. News list. For the school ranked second on the U.S. News list, their students average debt was almost double the debt incurred by Princeton students at graduation.

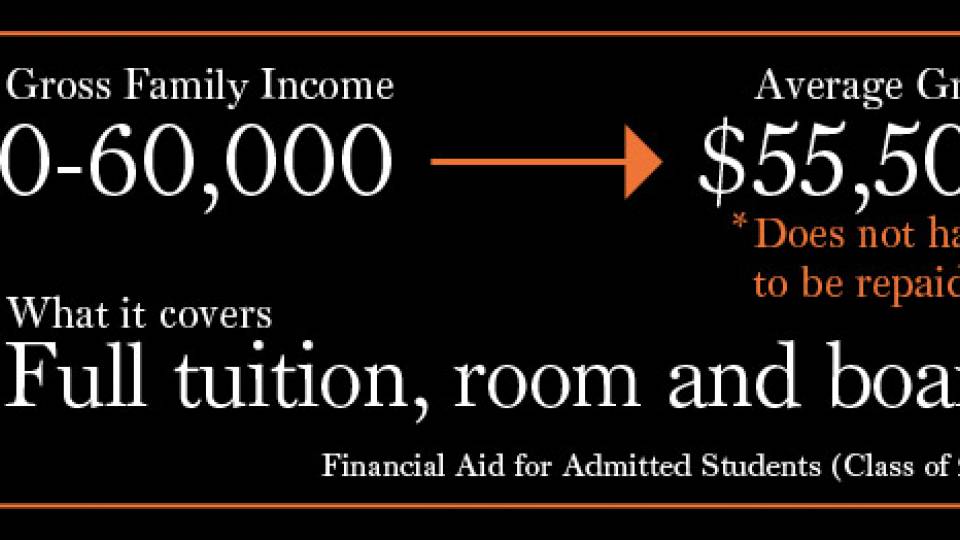

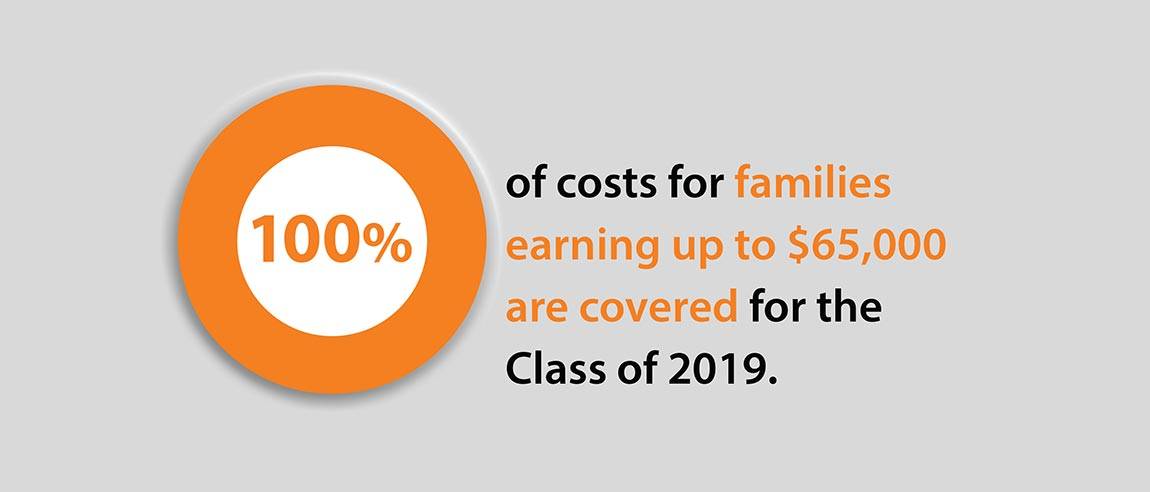

Princeton's financial aid program has ensured the continued and growing enrollment of a diverse group of students from low- and middle-income backgrounds. For students in the Class of 2019 with family incomes of $65,000 or less, the average financial aid package covers all of their costs for tuition, room and board.

Princeton's financial aid policy covers costs for students from a broad range of socioeconomic backgrounds. The aid package covers 100 percent of tuition costs for students in the Class of 2019 who applied for aid with family incomes up to $140,000.

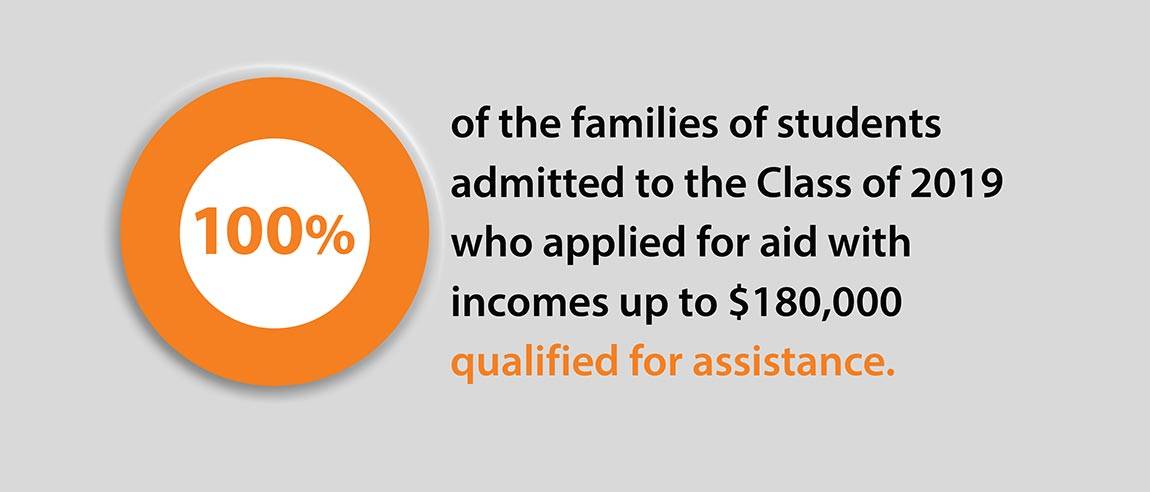

Families from middle- and upper-middle income backgrounds also qualify for financial aid. For students in the Class of 2019, all students who applied for aid with family incomes up to $180,000 qualified for a financial aid package to meet their individual amount of demonstrated need. In addition, 83 percent of students who applied for aid with family incomes of $250,000 qualified for assistance.

Graphics courtesy of the Office of Admission