Princeton University's endowment earned a 0.8 percent investment gain for the fiscal year that ended June 30, 2016. The endowment value stood at $22.2 billion, a decrease of about $570 million from the previous year.

The average annual return on the endowment for the past decade is 8.2 percent, which places the University's endowment among the top percentile of 461 institutions listed by the Wilshire Trust Universe Comparison Service. The Princeton University Investment Co. (PRINCO), the University office that manages the endowment, will certify the results during a meeting of its directors on Oct. 20, 2016.

"We are grateful to PRINCO for achieving a positive return in a difficult year," Provost David Lee said. "Even with the positive return, the overall value of the endowment declined because of the annual distributions we make to support the operating budget. The endowment allows the university to sustain the excellence of its research and teaching programs as well as to maintain its commitment to its generous financial aid program and full access for any student who is admitted, regardless of ability to pay and without the need for students to take out loans."

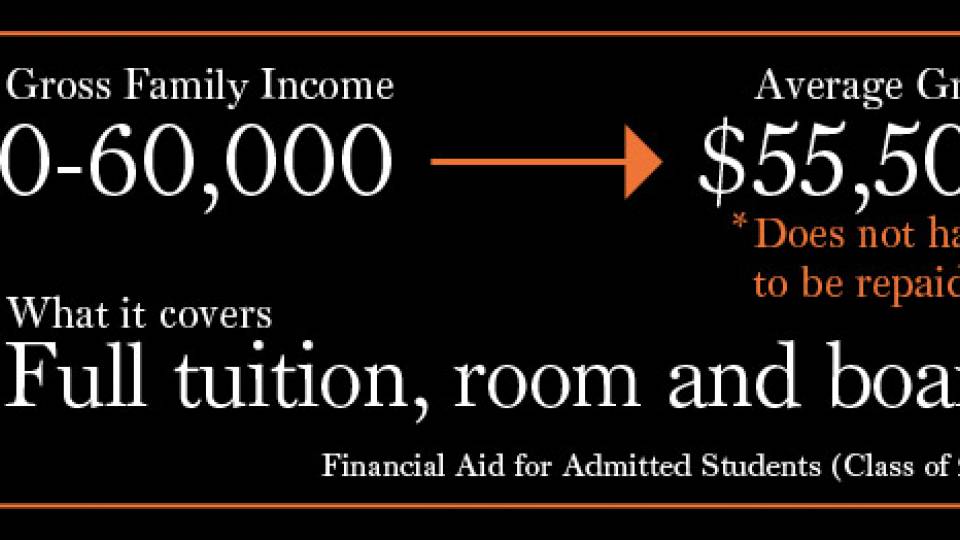

Early this year, Princeton University trustees approved a 6.6 percent increase in undergraduate financial aid to $147.4 million in the University's operating budget for the current year. As a result of the University's efforts to increase the economic diversity of the student body, 21 percent of the members of the Class of 2020 are eligible for Pell grants, up from 7.2 percent for the freshman Class of 2008.

Typically, Princeton students from families with the U.S. median household income of $56,500 pay no tuition and their average grant also covers room, board and other expenses. Most students from families with incomes up to $140,000 pay no tuition, and for an average family with income around $160,000, grant support covers roughly 95 percent of tuition.

![Princeton Budget Report: “Gross Family Income = $0-65,000 Average Grant* = $60,375 *Does not have to be repaid; What it covers: Full tuition, room and board [Financial Aid for Admitted Students (Class of 2020)]”](/sites/default/files/styles/half_1x_crop/public/images/2016/04/pricom_WhatItCovers_homepage.jpg?itok=jIyD9zJ1)