|

Photovoltaic in China: what to expect, a recession or a breakthrough? by Hao Chen (ELE) |

|

| |

|

Abstract: China has become one of the major players in the global photovoltaic (PV) industry, particularly in production of solar cells and modules. Driven by high profit in the PV industry, China’s production capability has been dramatically increasing during the last decade. However, the global market recession in 2012 exposed the issue of overcapacity, and other problems. This article will briefly discuss China’s PV development in two levels: market opportunity and technology breakthrough. It is meant to answer the question of where we stand and where we should go. |

|

|

Clean renewable energy has been a hot topic over decades. Most of the major countries across the world have their own plans to develop clean energy or sustainable energy, especially for photovoltaic (PV) industry. Photovoltaics (PV) is a method of generating electrical power by converting solar radiation into direct current electricity using semiconductors (e.g., c-Si, poly-Si, CdTe, CIGS, etc.) that exhibit photovoltaic effect. Photovoltaic power generation employs solar panel modules consisting of tens of solar cells. The advantages of photovoltaic include noise-free operation, simple installation, long lifetime, and adaption to scattering light. Due to the growing demand and high profit return, manufacturing of solar cells and photovoltaic arrays has advanced considerably in recent years. Solar PV is now the third most important renewable energy source in terms of globally installed capacity, behind hydro and wind power [1]. By the end of 2011, the global installation capacity has reached 67.4 GWp, sufficient to generate a total of 85G kWh per year [2]. The major installation locates in Europe, in particular, Italy and Germany.

PART I : PV development in China and the recession in 2011

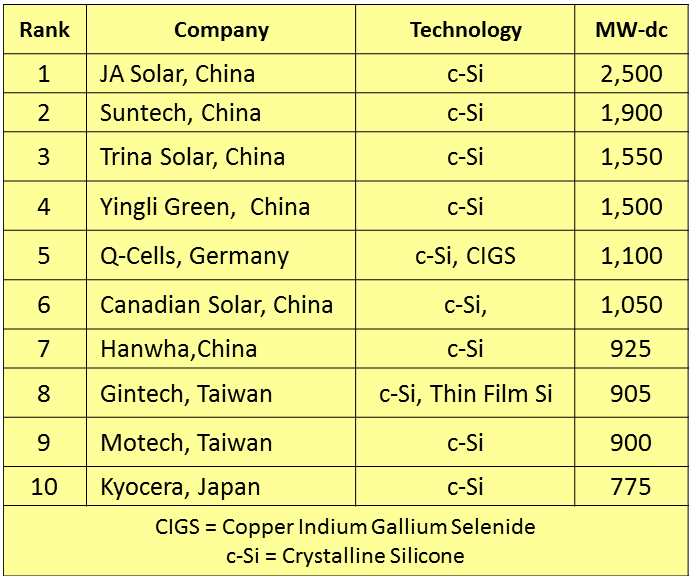

PV development in ChinaChina starts its government subsidy to PV development from the seventh Five-Year Plan, but in a very small scale. However, during the first decade in the 21st century, China PV industry boomed in a tremendous speed. The incentive is that during this period, the global economy runs so well that many countries in Europe decide to expand PV installation capacity and did invest in it. Due to the high demand and the high profit at that time, hundreds of PV companies were founded in China and started making solar cells and assembling solar modules. Almost all of the PV products were exported to Europe and the US. Local government in China saw the opportunity to produce GDP and increase tax revenue, and encouraged more capital to be invested in this industry. Fast growth is obvious. After 10 years, by the end of year 2011, there are already six companies from China mainland listed as TOP-10 manufacturers of solar cells regarding to mega-watt of output. They are: JA Solar (晶澳), Suntech (尚德), Trina Solar (天合), Yingli Green (英利), Canadian Solar (阿特斯) and Hanwha (韩华). (See Table I below [3]) In addition, among the top-10 manufacturers of solar “modules” (assembled from solar cells), China companies also occupy six spots (not shown here [3]). The total amount of existing production capacity in China is 30GWp (including contracted), while this number is only 50GWp for the whole world. There is no doubt that China has become the leader in PV production, at least in terms of capacity.

Table I Top 10 Largest Solar Cell Manufacturers by 2011

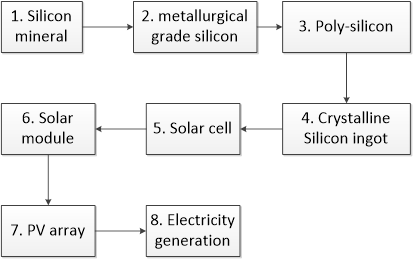

In technology level, we can easily notice from Table I that the technologies used by all the China manufactures are identical ---- crystalline silicon. It is not because such products are cost-effective (solar-cell quality silicon wafer is expensive), but because the technology is mature and manufacturing facility is available in the market. China companies are basically taking advantage of existing technology. For almost all the China manufactures, developing a solar cell line seems like mission impossible. Therefore, they import whole production line from Europe vender, purchase high quality silicon, train workers and then start to fabricate solar cell and sell them back to Europe. Admittance into PV industries used to be so straightforward and so profitable that many companies, who barely have technology base in PV, got involved. They became one of those PV manufacturers by following this industry pattern of “processing with supplied material”. However, for most of the key technology in production, such as PECVD SiNx anti-reflection film, screen painting, etc., China manufacturers still lack of mature technology to complete the process independently. Unfortunately, such a large technology gap failed to draw enough attentions to most of the manufacturers. Among those hundreds of PV companies, only 2%-3% companies have independent R&D departments focusing on PV technology advancing and core intellectual property [4]. Others just concentrate all their energies on practical production. Most of them might be already far behind the technology advancing. Another issue is that, though PV development seems a huge success in China, all of the players involved are only investing in solar cell production and solar modules assembling. Actually, PV cell and PV module are only two segments of the whole PV industrial chain. A complete PV industrial supply chain is shown in Figure 1.

Figure 1. PV industry supply chain. Government subsidy to PV electricity generation in Europe stimulated the fast growing of the whole industry. As other segments, step 5 and step 6 in the supply chain used to be profitable. However, as more and more manufacturers got involved, majorly from China, competition became so intense that margin kept shrinking. On one hand, it forced players from other countries to either be kicked out of the business or turn to advanced technology; on the other hand, as the price advantage of China PV product is not coming from advanced PV technology but mainly from low labor cost in China, solar cell manufacture has since become another labor-intensive industry, just like electronics and textile industry. Currently solar cell manufacture can be seemed as the segment with the lowest gross profit in the whole PV chain. Dr. Zhengrong Shi, CEO of Suntech (尚德), once estimated the industry gross profit to be at 5%, and would be maintained at this low level in the future due to highly intensive competition. Despite of this, China manufacturers seem addicted to it and keep expanding capacity. Once a recession comes, local governments in China have to bail out those companies once and once again in consideration of local unemployment rate. Therefore, PV development in China is so unbalanced: at the beginning of the chain, China barely has capacity to produce enough crystalline silicon to meet the demand from its solar cell fabrication; at the end of the chain, China still do not have a grown-up market that can consume that many solar cells produced. At this point, PV industry in China is like a giant with very small head and tail. Overcapacity issue in 2011From 2007 to 2011, PV demand grew at an average rate of 70% per year. Production was forced to accelerate to keep up with demand. The rule to survive was that those companies who were able to dramatically expand capacity could win market share. Demands weres so urgent and firm that no one thought the industry growth would come to an end in the near future. Every company expanded their capacity dramatically. No matter how much the capacity was created, the market easily absorbed the added capacity. As remarked by Jürgen Grossmann, the CEO of German utility RWE, producing solar power in Germany is like “growing pineapple in Alaska”. The only incentive that drives people to do that is government subsidy. PV industry is still in a stage that it is so dependent of government support that if one day government withdraws the subsidy, the whole industry might collapse. Good luck for PV industry continued until early 2011, when governments reduce their subsidy due to high deficit from financial crisis recovery and the outbreak of European sovereign-debt crisis. Suddenly the global production capacity was over global demand. Capacity still kept going up but the market shrunk significantly. Second and third tier companies had to reduce their piling-up inventories, worsening the situation by making prices of c-Si silicon solar cells plump. Prices of all the PV related products (modules, cells, wafers, and poly-silicon) dropped dramatically. For example, wafer prices dropped about 70%, solar cells dropped about 60%, and modules dropped about 50%. Many smaller producers had to suspend their operations. As a result, almost all the companies in the PV industry suffered great losses in 2011.

|

|

Copyright 2012 by Princeton University China Energy Group. All rights reserved. |