|

Photovoltaic in China: what to expect, a recession or a breakthrough? by Hao Chen (ELE) |

|

| |

PART II : Recovery and Future Development for PV in China

PV Collapse in 2011: Waterloo or Opportunity?The huge recession in 2011 was indeed a great shock to the PV industry, especially for PV manufacturers in China who were already suffering lowest gross profit. The negative effect of recession is obvious. For example, upstream solar supply chain shrinks more than 75% by 2012, according to IHS solar research. The negative effect is believed to continue to influence the whole industry to 2012 and 2013. For the upstream supplier it may take longer to recover. However, the real question people concern is that, is this a turn point that indicates a future downhill development for PV, or just a small hurdle that every industry has to overcome when it grows up? Although the future cannot be precisely predicted, based on the best of my knowledge, I believe recession in 2011 should not be deemed as a fiasco, but an opportunity to the whole industry. From a point of view in terms of the cause of this recession, it is not because new technology replaces PV, nor new regulation comes to effective to limit PV development, but just because the government reduced their subsidies. Actually it is not a bad news, since government subsidies will be gone sooner or later. A healthy industry growth should be independent of government subsidy and sustain on its own. Like all the industries in the past, government subsidy reducing could be a good opportunity for a thorough consolidation within the industry. It forces those tier-2 and tier-3 to be kicked out of the market. As mentioned above, among those hundreds of PV companies in China, a large portion of them pitched into this business simply aiming at the high profit. Now it can be a good time to force them out and concentrate advantage resources to those few manufacturers, who have advantages in brand, size, cost and technology. With fewer players on stage, vicious competition that down-press gross fit could be avoided, and those major manufacturers can possess more power in price negotiation. Gradually, profit in cell and module manufacture will be back to the normal level where it should be. Then, how to get out of the mud?

Find opportunity in the whole supply chainAs we mentioned above, the whole supply chain consists of upstream (silicon mineral, poly-silicon), midstream (wafers), and downstream (solar cell, modules and installation) business. Since the downstream is so congested with Chinese manufacturers, it won’t hurt to seek opportunity in other area in the whole supply chain. Upstream business used to be the most profitable. However, as the poly-silicon price dropped from $500/kg to as low as $20/kg, margin has been pressed so hard that only those companies with large scale capacity can survive. In the upstream, there will be only 5-6 major manufacturers left in the market. China has two major companies in the upstream, Golden Concord (保利协鑫) and LDK (江西赛维). Currently there total capacity still cannot satisfy the downstream demand in China. Therefore, if they can survive in the fluctuation this time, there will still be much room for them to grow up in the future. Midstream (wafers) might have been long forgotten. Wafer fabrication basically melts the poly-silicon and grows crystalline silicon through special process (i.e., Czochralski process). The manufacture sets high requirement to the fabrication technology, thus fewer companies run their business in this field. Due to the high criterion set by advanced technology, profit for midstream companies still remains considerable, even during the recession. Zhonghuan (中环股份) is a significant midstream company in China, who possesses IP of world-leading technology for silicon growth. Zhonghuan managed to keep its gross profit rate at ~19% in 2011, much better than the whole upstream and downstream industry. Therefore, we have the reason to suggest downstream companies pay more emphasis on R & D and explore those areas with higher technology requirement and thus receive higher profit.

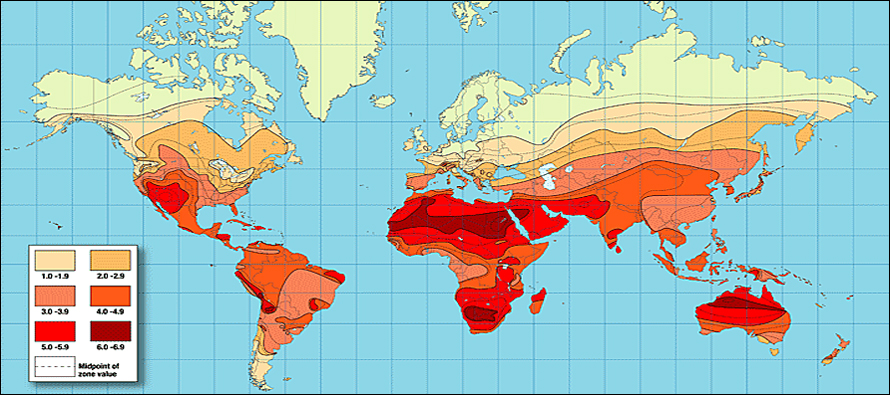

Have we fully explored the global PV market?Currently more than 80% of the PV products in China are exported to Europe and the US, the two most mature markets in the world. They have complete pricing system, advanced PV technology, and standardized operated corporation. But the truth is, demands from those two markets have gone weak, and it is very likely that both economies will turn to trade protectionism to protect domestic PV companies (e.g., the US has started anti-dumping investigation). Why don’t we look around the world and seek opportunities in other promising markets? For Chinese manufacturers, the most promising market could be China itself. However, this market is still far from grown-up. Taking data from 2011 as example, current and developing production capacity in China is 30GWp (50GWp across the whole world). According to the PV industry plan in the Twelfth Five-Year Plan (Ministry of Industry and Information Technology of China), China is trying to reach a total PV capacity of 15 GWp by the year 2015. It means that if half of China’s yearly deliverability is installed where they are produced, China can easily achieve the 2015 goal in a year. But unfortunately, the capacity China installs every year is less than 10% of what can be produced in this country. Nevertheless, good news is that, though not grown up yet, demand from China for PV product has increased significantly. China aims at quadrupling its total PV capacity by 2015 from 2011. Once the market takes off, China PV manufacturers should greatly benefit from their price advantage and policy advantage. There is no doubt that Chinese companies will win almost all the business easily due to its lower price. In addition to local market, immature markets with natural solar power resources could be very promising in regards to market growing. Fig.3 maps the worldwide solar energy resource distribution. Generally, low latitude areas naturally possess rich solar resource. Interestingly, however, PV businesses in most of these areas are far from developed, like South East Asia, India, South America, Mexico, and the whole Africa continent (PV even not started yet). During the past decade, the whole PV industry had paid so much attention to the European and US market, that most manufactures were reluctant to cultivate other promising markets.

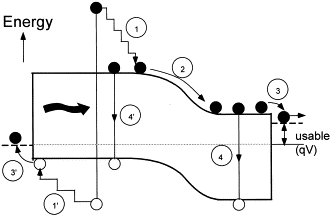

Fig. 2 World Solar Radiation Map [5]. The first step to explore new market should always go to those countries with rich solar resource and stable economy. It is those countries who might have strong willing to develop clean energy, since PV industry is costly but can further boost local economy. Take South East Asian countries for example. According to IMS research, the total installed capacity is going to reach 5GWp by 2016, with average yearly growth rate of 50%. This is a very attractive market, especially at this moment when other markets are in recession. In South East Asian area there has already emerged two important countries, Thailand and Indonesia. Thailand is the leading country of PV installation in South East Asia, who has become the fifth large market in Asian, after Japan, China, Australia and India. Its Alternative Energy Development Plan (AEDP) plots that 14.1% of total consumed energy will be provided by renewable energy source by 2018. Its total capacity has reached 1.8GWp (installed and under contract) [6]. PV product is now in a historical low point. For many of those countries with a tight budget, they probably will choose this right moment to jump into PV market, taking advantage of lower price technology and product. China manufacturers could seize this opportunity and expand their influence in these countries with taking-off market. Technology advanceNo matter how the global market evolves, advanced technology is always the reason for high profit and drives the industry forward. Currently PV industry is still suffering from the high cost of manufacture and low efficiency of PV conversion. High manufacture cost with low efficiency leads to a long return period, which is not welcomed by investors. Therefore, technology advance in PV industry majorly focuses on how to improve solar cell efficiency while keeping the cost low. Fortunately, people have achieved progress in both aspects. In regards of reducing cost, the most important revolution is cost saving on substrate materials by using thin-film semiconductor material to replace bulk material. Taking silicon solar cell for example, only the top 5um-thick of silicon layer is effective for solar energy absorption. It means that for a 200um-thick silicon wafer, more than 95% cost on silicon is a waste. Thin film technology only deposits the thin active layer for several microns thick, which can locate on top of a cheap, regular substrate. Since the effective layer thickness is guaranteed, total solar cell efficiency will not be affected, but the total material cost will significantly dropped. Currently, First Solar, the largest manufacturer in the US has all its products based on Cadmium Telluride (CdTe) thin film; Sharp, the largest manufacturer in Japan, also has part of its capacity producing silicon thin film solar PV modulus. For manufacturers in China, such technology has not become a trend yet. In an efficiency view, there are many ways to cause an inefficient solar cell. The major energy loss mechanism includes (fig. 3): (i) hot carrier loss; (ii) energy loss during junction transverse; (iii) contact loss; and (iv) carrier recombination. Besides, there is another intrinsic loss due to limited material absorption spectrum, which means that material will have lower absorption efficiency at certain range of wavelengths.

Fig. 3 Major energy loss mechanism in solar cell [7]. Currently the most efficient silicon-based solar cell has an efficiency of 25%, close to theoretical Shockley-Queisser limit of 33%. However, even 33% is still not enough, suffering a two-third energy loss. Actually, pursuing a high PV efficiency has been a hot topic in the lab research for decades. Some of the technologies developed is promising and thus draws much attention:

There are many technology advances still going on. We just name a few here. PV innovation is still a very active research area that attracts researchers all over the world to make progress in the technology advance. In summary, solar energy will embrace its prime time in the near future. Current setback is just a small episode that won’t lead to an end. After all, PV energy application is a trend, and eventually will dominate the renewable clean energy production.

Reference

[2] European Photovoltaic Industry Association (2012). "Market Report 2011" [3] http://solarcellcentral.com/companies_page.html [4] 中国光伏发电企业现状 (百度文库) [5] http://solarcellcentral.com/solar_page.html#inverters [6] http://www.chinaaseantrade.com/news/EF/YLZDL.html [7] M. A. Green, Materials Science and Engineering: B, 74 (1-3),118 (2000) [8] National Renewable Energy Laboratory (NREL) [9] S. Y. Chou and W. Ding, Optics Express 21, S1, A60 (2013) [10] M. D. Kelzenberg, et al., Nature Materials 9, 239 (2010)

|

|

Copyright 2012 by Princeton University China Energy Group. All rights reserved. |